Honeywell Lifts Dividend to $1.19 as Earnings Strengthen

Share

Honeywell International (NASDAQ: HON) announced a 5.3% dividend increase to $1.19 per share, effective December 5.

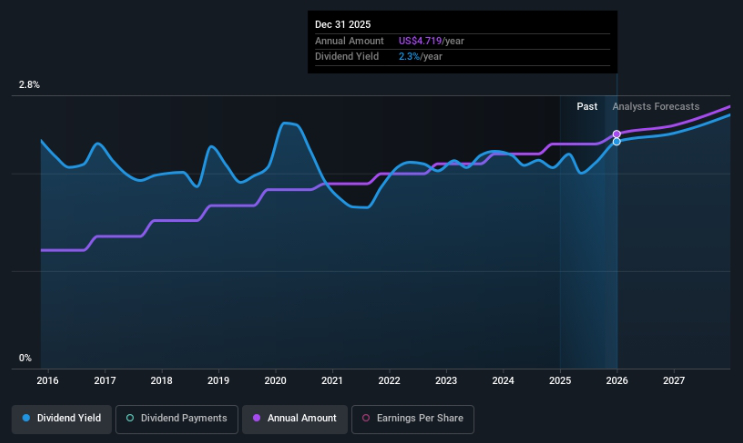

The new payout lifts Honeywell’s dividend yield to 2.2%, aligning with the industrial sector average.

Earnings Growth Supports the Dividend Boost

Honeywell continues to generate strong earnings that comfortably cover its dividend.

The company invests a significant portion of its profits back into its business to fuel innovation and automation growth.

Analysts forecast a 37.4% jump in earnings per share next year, keeping the dividend outlook healthy.

If that growth holds, Honeywell’s payout ratio could reach 40%, a sustainable level for the long term.

A Consistent History of Dividend Growth

Honeywell’s dividend track record shows reliability and consistency.

In 2015, annual payments stood at $2.07. By 2024, that figure climbed to $4.52.

This reflects an 8.1% annual growth rate—a strong signal of management’s long-term commitment to shareholders.

Investors continue to value Honeywell’s steady returns in a market where stability matters.

Limited Dividend Growth Potential Ahead

Although Honeywell remains profitable, its earnings per share growth has flattened over the past five years.

The company is channeling more cash to shareholders as it struggles to find large-scale investment opportunities.

This suggests future dividend increases may moderate, especially as Honeywell balances innovation and shareholder returns.

A Reliable Income Stock for Industrial Investors

Honeywell’s consistent dividend growth reinforces its image as a dependable income stock.

The company converts strong earnings into reliable cash flow, supporting future shareholder returns.

While growth may slow, Honeywell still offers solid income stability in the industrial automation space.